Navigating the 2025 Real Estate Landscape

February 26, 2025 | Author: David J. Murphy

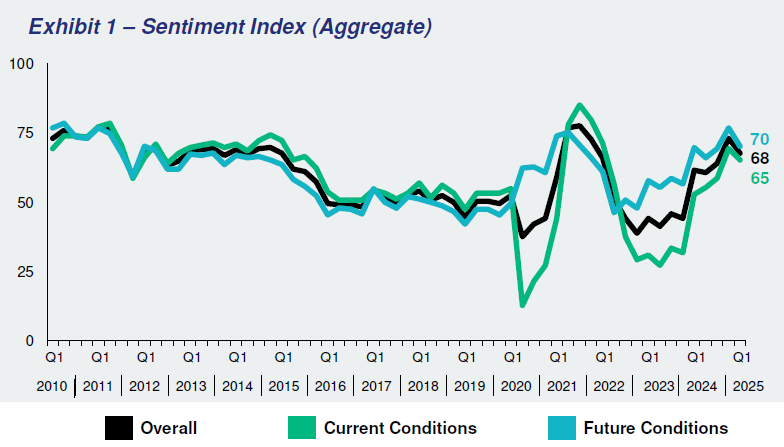

The Q1 2025 Real Estate Roundtable Sentiment Index reveals a market in transition. The Real Estate Roundtable Sentiment Index measures the confidence and expectations of senior executives in the commercial real estate industry. Though sentiment has decreased 5 points from last quarter, the index remains 7 points higher year-over-year, suggesting a gradually improving environment. For small and mid-size developers, this mixed outlook presents specific challenges and opportunities in the months ahead.

What This Means For You:

- Capital Access is Improving: With 62% of respondents noting better debt availability compared to last year, financing conditions are gradually normalizing. As one survey participant noted, “Banks are coming back, and private credit is growing like crazy.” However, another cautioned that “it’s difficult at this point to create a new relationship on the debt side. People are lending with existing relationships, or with very strong sponsors who want very low leverage.” Now is the time to solidify banking relationships and demonstrate strong fundamentals.

- Selective Investment is Key: In this more discriminating market, focus on properties with strong fundamentals and clear demand drivers. The days of “rising tide lifts all boats” are behind us.

- Insurance Costs Require Major Reassessment: Rising insurance costs emerged as a key concern in the survey. As one executive emphasized, “We’ve had to completely rethink our assumptions on insurance costs; they will be much higher for the foreseeable future compared to historical levels. They’ve depressed property values, but it will take time for property taxes to catch up with those values.” For smaller developers, this means fundamentally revising pro formas and potentially exploring creative risk-sharing arrangements.

- Policy Shifts on the Horizon: Industry leaders expressed “cautious optimism” about the new administration, with one noting, “I think some of the policies, such as tax incentives or something like the Tax Cuts and Jobs Act (TCJA), will increase investment overall.” However, uncertainty around tariffs, tax policies, and regulatory changes requires maintaining flexibility in your acquisition and development strategies.

- Asset Class Divergence Continues: Industrial and multifamily sectors saw substantial volume in 2024, but as one industry leader stated, “We should have seen a peak level of industrial and multifamily construction activity in 2024. Now, hopefully, we see a bit of a slowing of deliveries.” Another noted, “Multifamily assets are going to see an outsized value over the next several years. We will also see a shift from a renters market to a landlord market.” Meanwhile, the office market remains bifurcated with Class B and C properties continuing to struggle significantly.

New England Market Focus

Developers operating in the New England region should focus on the following strategies:

- Leverage Historical/Urban Core Advantages: New England’s dense, historic urban centers continue to maintain higher occupancy rates than suburban equivalents. Small and mid-size developers should focus on adaptive reuse and infill opportunities in established neighborhoods where zoning constraints create natural supply limitations.

- Address Regional Insurance Challenges: New England faces particularly acute insurance cost increases due to climate concerns and aging infrastructure. Developers should consider enhanced resilience features in both new construction and renovations to mitigate these rising costs and potentially qualify for emerging “green building” insurance incentives.

- Target Housing Shortages in Secondary Markets: While Boston remains competitive, cities like Providence, Portland, and Hartford offer more accessible entry points with significant housing shortfalls. The region’s strong academic institutions continue to drive demand for both student and workforce housing, creating sustained opportunities despite national multifamily oversupply concerns.

The Sentiment Index shows transaction volumes are currently “at an all time low, on par with 2008,” but with substantial dry powder waiting to be deployed. As one executive put it, “pent-up capital will come back to the marketplace. People will find a way to make the numbers work.” Smaller, nimbler developers have better opportunities ahead of the broader market.

David J. Murphy is the managing attorney of the law firm of Murphy PC in Boston, Massachusetts. He regularly represents real estate developers and investors in real estate development projects.